At Moonshot Insurance, technology is at the heart of our commitment to an outstanding customer experience. Thanks to our advanced technological solutions, we simplify the management processes for your customers, offering them an intuitive online platform for managing their insurance policies and to submit claims. Our automation speeds up processes, guaranteeing a smooth, problem-free experience thanks to our APIs. By offering the best insurance product tailored to each customer's specific needs, we are committed to offering competitive rates. Our aim is to provide the best product, at the best price, at the right time.

Save time and money by focusing on your core business, while gaining detailed access to your program's performance. Moonshot Insurance: Tech enabler As a Tech Enabler, we offer companies the opportunity to regain control of their insurance programs by integrating our products directly into their existing applications or platforms. Thanks to our embedded insurance approach, customers can easily underwrite, manage and adjust their insurance policies, without having to navigate between different interfaces. Daily monitoring and reporting: Our dashboards make it easy to track the performance indicators of your insurance program. We automate these indicators on a daily basis to give our partners clear visibility of their underwriting, identify trends and make informed decisions.

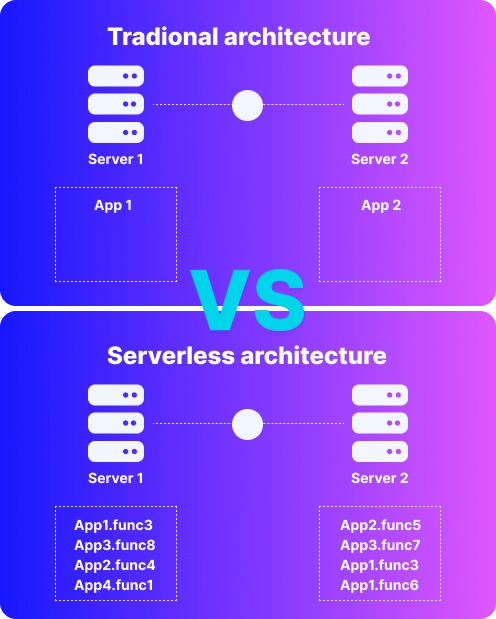

API for autonomous access to the product catalog Thanks to our approach based on a single API for multiple insurance products, we can considerably simplify implementation for our customers. This approach avoids the complexity of maintaining a catalog with thousands of SKUs and matching it to the insurance program. What's more, our customers don't need to maintain an internal database to store our prices, as these are communicated directly via our APIs. This absence of maintenance and upgrade workload for our customers reduces operational and testing costs, while cutting the time needed to roll out product or pricing upgrades. By offloading the IT workload of e-merchant partners, our solution frees up their IT resources to concentrate on their core business. Serverless architecture for scalability Thanks to our serverless architecture, we are able to scale our services at the speed of our customers. This is a concrete example of our commitment to providing high-quality services and supporting our partners' growth without compromise.

On the customer side: no impact on the customer's experience. They are simply offered a relevant insurance product on the product page they are viewing. On the distributor's side: no management, no maintenance and no loss of time, just one simple action: send us your product catalog so that we can test its compatibility with our insurance products. Innovation also lies in our ability to manage a multiplicity of products with a single API, and therefore a single workflow. Once implemented, e-tailers can concentrate on their core business, while benefiting from the additional revenue generated by the insurance program - without the effort!